KYC in banking: Why it’s important and how to comply

KYC, or Know Your Customer, sometimes Know Your Client, is a critical process in the banking industry. Its purpose is to ensure that banks are doing business with legitimate customers and that they are complying with KYC bank regulations. The importance of KYC cannot be overstated—it helps protect both the customer and the bank from fraud and other illegal activities. In this article, we will discuss why KYC is so important and how you can comply with KYC bank regulations.

Why is KYC important?

KYC is the most important part of maintaining a healthy financial system. KYC guidelines help prevent banks from being used by criminals for money laundering activities but also enable them to serve their customers better and manage risks wisely.

KYC means identifying and verifying the customer’s identity through independent, reliable documents, data, or information sources.

The bank will obtain customers’ identity information, addresses, and recent photographs. Similar information must also be provided for joint and mandate holders.

For non-individual customers, banks will obtain identification data to verify the legal status of the entity, its operating address, authorized signatories, and beneficial owners.

Banks may refuse to open an account or halt a business relationship if the client fails to meet minimum KYC requirements.

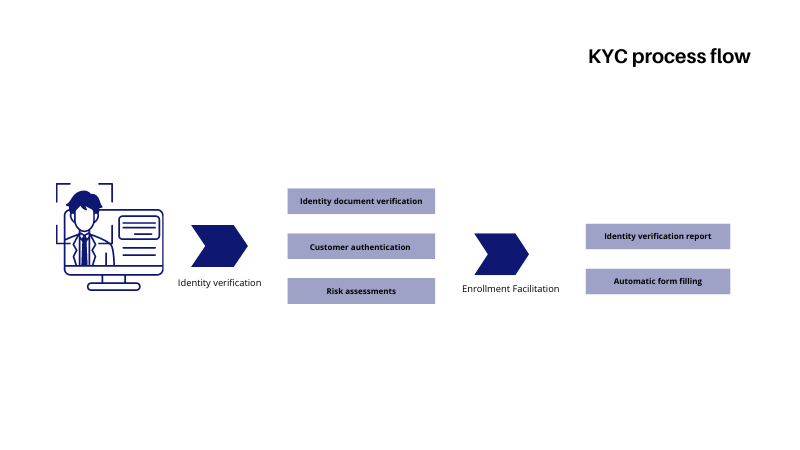

How does KYC work in banking?

Right now, the KYC process can be broken down into three steps. First, banks collect customer information, such as the customer’s name, address, and date of birth.

Second, banks verify this info. This is usually done by comparing the information to public records.

Finally, banks update their customer information regularly to ensure that it is accurate and up-to-date.

In case of failure to comply, heavy penalties can be applied.

What information do banks need for KYC?

Banks need to collect different pieces of information for various types of accounts. As mentioned, banks must collect the customer’s name, address, and date of birth for most individual accounts. For non-individual or business accounts, banks must collect the company’s tax identification number, the entity’s status, and the beneficial owners.

Types of KYC in the banking sector

There are different types of KYC in the banking sector that banks have to follow.

The mandatory KYC information for opening a bank account includes the following:

– Proof of address

– Proof of Identity

– Proof of Date of Birth

– Citizenship or Residency Status

– Tax Identification Number (TIN) or Social Security Number (SSN)

Banks may also require additional KYC information depending on the type of account or transaction. For example, banks may require customers to provide proof of income or employment when opening a new account or applying for a loan.

How often do banks need to update KYC information?

Banks are required to update their KYC information regularly. This is usually done once a year or when there are changes to the customer’s information. This is why when visiting a bank or contacting one through a phone line, the person on the other side often confirms your current address and contact information.

To comply with the KYC regulations, keep your relevant data up-to-date.

What are the benefits of KYC?

KYC has many benefits for both banks and customers. By complying with KYC regulations, banks can show they are committed to protecting their customers. This can help to build trust between the bank and its clients. Additionally, KYC can help prevent fraud, money laundering, anti-social and illegal activities.

This helps to invite stability and investments to the country by making the financial framework less risky and trustworthy. Minimized uncertainty allows institutions to lend more to customers, increasing the investors’ and local economies’ profits.

Several countries and economic regions oversee financial anti-money laundering agencies or regulators that overview financial transactions to prevent tax evasion, terrorism financing, and other anti-social activities.

These agencies are part of the Global Financial Action Task Force (FATF), which oversees global financial transactions.

What are the challenges of KYC?

There are also some challenges associated with KYC compliance. One challenge is that collecting and verifying customer information can be time-consuming and expensive for banks.

Additionally, KYC requirements for banks may differ from country to country. This can make it difficult for banks with customers in multiple countries to comply with all KYC regulations.

This is why reaching sustainable, effective compliance is currently an industry objective. This is where ever-evolving technology enters the scene.

KYC and LEI

The Global Legal Entity Identifier Foundation (GLEIF) undertook research with a specialist research agency, Loudhouse, to identify the key challenges of legal entity identification in financial services.

The GLEIF report details how replacing disjointed information with a globally accepted approach – based on broad adoption of the Legal Entity Identifier (LEI) would deliver immense value and simplify business transactions.

GLEIF is the world’s first and only global leader in reference data for legal entities. We make available open, standardized, high-quality information that saves businesses time and provides a single point of access to every jurisdiction around the globe.

The potential impact will be huge: the LEI offers businesses a one-stop approach to identifying legal entities, which has the potential to take the complexity out of business transactions. This is done via the Global LEI Index, an online source that provides open, standardized, and high-quality legal entity reference data. No other global and open entity identification system has committed to a comparable regime of regular data verification.

Integrating the LEI into other entity verification methods, including digital certificates and blockchain technology solutions, will allow anyone to easily connect all records associated with an organization and identify ‘who owns whom.’

The LEI will provide certainty of identity in any online interaction, making it easier for everyone to participate in the global digital marketplace.

What is a Legal Entity Identifier?

The Global LEI System (GLEIS) was developed by the G20 in 2011 in response to the 2008 global financial crisis to avoid future global shocks of that severity. The LEI code is now essential for legal entities operating within today’s financial system.

The purpose of the LEI code (a combination of 20 letters and numbers) is to allow the identification of any organization or legal entity on a worldwide database.

A company’s LEI will be public and contain data about the company’s registered and trading names: company type, registered address, registration number, parent company information, and child company information.

After forming the G20 concept, the Financial Stability Board (FSB) appointed a new not-for-profit organization, The Global Legal Entity Identifier Foundation (GLEIF), to oversee it. The foundation doesn’t issue the codes but leaves them to a network of public and private companies acting as Local Operating Units (LOUs).

Furthermore, to obtain an LEI code, you’ll need to reach an LEI Registration Agent.

LEI Register’s role is to provide you with verified information about LEIs, process data, and manage communication between LOUs. We understand the value of your time and have put in great work to become the fastest, most secure global registration service provider.