LEI renewal

Register or renew multiple LEIs at once

Register or renew multiple LEIs at once

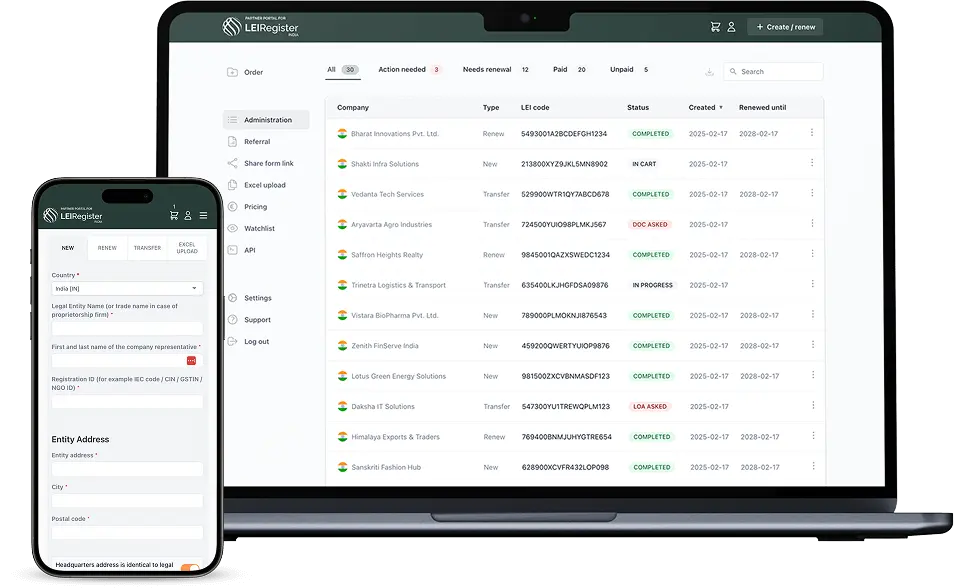

Smart solution for managing

your clients' LEI codes

- Get started quickly Create an account and start administering LEIs right away.

- Flexible options From API integrations to individual LEI applications.

- Join hundreds of businesses Financial institutions, investment managers, chartered accountants and more.

-

1. Complete the LEI code registration application form and ensure all required information is entered accurately.

For Pension Schemes or Trusts, a document (Trust Deed) must be uploaded to verify the entity’s legal address, Trust/Scheme name, and signing authority.

2. Submit the completed application form and pay the registration fee using a credit card or bank transfer.

3. The application data will undergo validation, and the LEI code will be sent to you via email.

If there are any issues with the information provided or the legal entity cannot be identified in public databases, you will be contacted to confirm the information.

-

Suppose a legal entity is not registered with a Registration Authority such as the Registrar of Companies. In that case, obtaining an LEI code by submitting supporting documentation such as a Trust Deed is still eligible when applying. The supporting documents must contain the entity’s name, authorized persons, legal address, and creation date.

The supporting documents must contain the entity’s name, authorized persons, legal address, and creation date.

-

You can apply for an LEI code even if you are not the legal representative of a company. However, you must obtain the legal representative’s signature on a Letter of Authorization (LoA) or provide a Board Resolution.

The LoA will be sent to you via email, and you can sign it electronically or print it and upload a picture/scan of the signed document. Alternatively, you can upload proof of empowerment.

-

Yes, you can apply for an LEI code for a company registered in another country. All you need to do is fill out the application form with details obtained from the local company registry.

We will then review the application and request any additional information if needed.

-

As per GLEIF’s guidelines, legal entities must disclose information about their direct and ultimate parent entities. However, merely owning shares of another company does not trigger the reporting requirement.

You must report a parent entity only if it owns controlling shares, typically over 50% of the child entity, and consolidates the financial results in its annual report. If the parent does not consolidate the results, then there is no parent/child relationship according to GLEIF’s terms.

If the parent entity doesn’t wish to publish its information, you can choose between different reporting exceptions on the form.

-

You will need to provide the name and address of the parent entity, the date when the relationship was first established, the accounting period covered by the latest consolidated annual report, and proof of consolidation.

The only acceptable proof of consolidation is the parent entity’s latest consolidated annual report.

-

A direct parent entity is the first known parent that consolidates the financial accounts of the child entity. On the other hand, an ultimate parent entity is the final consolidation parent of both the child and parent entities.

For example, if a company LEI Register LTD is owned by Legal Entity Identifier LTD (>50%), which is then owned by LEI Code LTD (>50%), and finally, LEI Code LTD is owned by Ultimate LEI Code Parent Holding LTD (>50%), the following entities should be reported:

- Child entity: LEI Register LTD

- Direct parent entity: Legal Entity Identifier LTD

- Ultimate parent entity: Ultimate LEI Code Parent Holding LTD

How to register an LEI code?

What happens if the legal entity is not registered?

Can I apply for an LEI code if I am not a legal representative of the company?

Can I obtain an LEI code for a company registered in a foreign country?

When and what should I report if another company owns my company?

What info should I provide if the annual accounts are consolidated under another legal entity?

How does a direct parent differ from an ultimate parent?

-

To renew your LEI code, follow these simple steps:

1. Enter your LEI code or company name into the renewal application form.

2. The form will automatically populate with your current data from the GLEIF database. If any information has changed within the year, you can modify it accordingly.

3. Submit the completed LEI renewal application form.

-

To keep your LEI active, it must be renewed annually. If the renewal deadline passes, the LEI becomes inactive, and financial institutions can block your transactions. This obligation ensures that the Global LEI Index remains accurate and up-to-date.

LEI Register India simplifies the renewal process with multiyear registration. We will be responsible for renewing your LEI for a selected period, providing our clients convenience and peace of mind.

-

The Global Legal Entity Identifier Foundation (GLEIF) requires companies to update their registration information annually through an LEI renewal process to ensure the reference data on the Global LEI Index remains accurate and up-to-date.

Conversely, an LEI transfer refers to transferring an LEI code from one service provider to another. The Global LEI System promotes an open market and encourages healthy competition among service providers, allowing clients to switch to a different provider anytime.

It’s important to note that your LEI code remains unchanged even if you switch to a different service provider. All LEI numbers are of equal value. The only modification to your LEI reference data will be the Local Operating Unit (LOU), also referred to as the LEI issuer name.

-

We understand that renewing an LEI code annually can be a time-consuming task. At LEI Register India, we offer automatic renewal for LEI numbers, available for periods of 1, 3, or 5 years.

With multiyear renewals, we’ll review and update your data annually based on registry updates and renew the LEI for you.

-

In cases where an LEI has lapsed, renewal is the only option available, as applying for a new LEI is impossible.

It is important to note that once an LEI code is assigned to a legal entity, it cannot be altered, as it serves as a unique identifier. Additionally, each company can only have one LEI code.

-

You can find the next renewal date by checking your LEI reference data on our search tool or by performing an LEI search on the Global Legal Entity Identifier (GLEIF) database.

If you have opted for a multiyear registration with us, you can easily retrieve the upcoming renewal date by checking our search tool

-

Maintaining an active status for your Legal Entity Identifier (LEI) is generally recommended. However, if you no longer require the LEI code, simply refrain from paying the renewal fee, and the LEI will automatically become inactive without any further action needed.

Please note that LEI codes cannot be deleted and will remain perpetually in the Global LEI Index.

How to renew an LEI code?

When and why do I have to renew an LEI code?

What’s the difference between an LEI transfer and an LEI renewal?

Can an LEI be renewed for multiple years?

If an LEI has lapsed, is it possible to renew it, or is a new LEI required?

Where can I check the renewal date for my LEI code?

What’s the procedure if I no longer require an LEI code?

-

LEI transfer is the act of moving the LEI code from one service provider to another. This allows the entity to choose which service provider they want to use based on their preference. LEI transfer is free; simply transferring your LEI will not renew it.

-

Each entity will be assigned an LEI code once, which will not change when moving service providers.

-

We have become market leaders by offering best value prices and keeping customer satisfaction as our top priority. As a result, we welcome new transfers every day and have greatly simplified the process of transferring an LEI code to LEI Register India.

-

Currently, your LEI is being handled by another service provider. If you wish to facilitate the renewal process of your LEI code with us, it is required to transfer your LEI under our management.

-

The completion of the transfer process may require a maximum of 7 days. To expedite the process, you can contact your current service provider and inform your intention to transfer your LEI code.

-

No, since all LEI codes are managed by GLEIF-appointed Local Operating Units (LOUs). LEI Register India is the official Registration Agent of Ubisecure Oy (RapidLEI).

Differentiating factors among LEI service providers include the simplicity of the process, processing time, and the cost associated with LEI registration and renewal. -

Regrettably, no refunds are provided for the remaining years of service after transferring your LEI code from our management to another service provider.